Personal loans for Qatar ID holders are one of the most in-demand financial products in the Gulf region today. Whether you are an expat professional, a government employee, or a long-term resident, having a valid Qatar ID opens the door to competitive loan options across top Qatari banks.

From home renovation to medical emergencies, these unsecured loans offer fast access to funds with no collateral required. Qatar’s banking sector, regulated by the Qatar Central Bank (QCB), ensures fair and transparent lending for all residents.

What Are Personal Loans for Qatar ID Holders?

Personal loans for Qatar ID holders are now more accessible than ever, whether you’re an expat professional, a long-term resident, or a government employee. Qatar’s banking sector is one of the most dynamic in the Gulf, offering competitive loan products tailored to residents across all income brackets.

With over 2.8 million residents in Qatar (Qatar Planning and Statistics Authority, 2023) and a large expat workforce, understanding how to qualify for a personal loan with your Qatar ID is essential financial knowledge.

A personal loan in Qatar is an unsecured lump-sum credit facility repayable in fixed monthly installments, available to both Qatari nationals and expats holding a valid Qatar ID.

A personal loan for Qatar ID holders is an unsecured credit facility offered by Qatari banks and financial institutions to residents holding a valid Qatar National ID (QID). These loans require no collateral and can be used for any legal purpose, from home renovation to medical emergencies or education fees.

Qatar’s banking system, regulated by the Qatar Central Bank (QCB), ensures transparent lending practices. According to Qatar Central Bank, personal loan activity has grown steadily with total household credit exceeding QAR 200 billion in recent years.

Eligibility Requirements for Personal Loans for Qatar ID Holders

Before applying, it’s important to check if you meet the basic eligibility criteria. Most banks in Qatar share similar requirements, though specific thresholds vary by lender.

Core Eligibility Criteria for Personal Loans in Qatar

- Valid Qatar ID (QID): Your Residency Permit (RP) must be active and not expired.

- Age Requirement: Minimum age of 21 years; maximum up to 60 years (Qatari nationals) or 58 years (expats) at loan maturity.

- Minimum Monthly Salary: Typically between QAR 5,000 and QAR 7,000, varies by bank.

- Employment Status: Must be employed with a government entity, semi-government, or an approved private company. Some banks accept self-employed applicants with verified income.

- Credit History: No active defaults or bad credit history as recorded in Qatar’s credit bureau system.

- Minimum Tenure: Many banks require a minimum of 3–6 months at your current employer.

Banks like QNB (Qatar National Bank) and Commercial Bank of Qatar further segment eligibility based on whether the employer is on their preferred employer list, which can unlock higher loan limits and lower interest rates.

Documents Needed to Apply

Having your documents in order before applying significantly speeds up the process. Here is a complete checklist:

| Requirement | Details |

|---|---|

| Valid Qatar ID | Must be valid and not expired (primary eligibility document) |

| Employment Status | Employed (government, semi-gov, private sector) or self-employed |

| Minimum Salary | Typically QAR 5,000–7,000/month depending on lender |

| Employment Letter | Salary certificate or NOC from employer on official letterhead |

| Bank Statements | Last 3–6 months of bank statements showing salary credit |

| Passport Copy | Valid passport with Qatar residency visa stamped |

| Proof of Residency | Utility bills or tenancy contract (sometimes required) |

| Good Credit Score | Qatar Central Bank credit report (no defaults or bad debts) |

Pro Tip: Having your salary credited to the lender’s bank account for at least 3 months often results in faster approvals and better interest rates. This is known as the “salary transfer” condition.

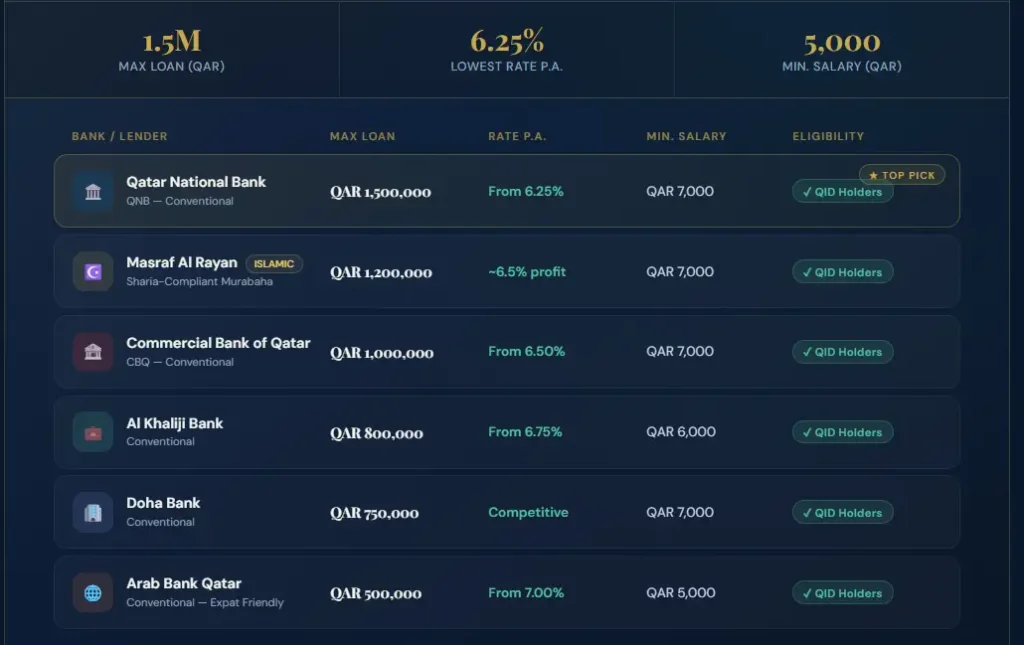

Top 7 Banks Offering Personal Loans for Qatar ID Holders

Use this comparison table to evaluate the best options available in Qatar right now. Rates are indicative and subject to change based on QCB guidelines.

| Bank / Lender | Max Loan (QAR) | Interest Rate | Min. Salary (QAR) | Residency Type |

|---|---|---|---|---|

| Qatar National Bank (QNB) | 1,500,000 | From 6.25% p.a. | 7,000 | Qatar ID holders |

| Commercial Bank of Qatar | 1,000,000 | From 6.50% p.a. | 7,000 | Qatar ID holders |

| Al Khaliji Bank | 800,000 | From 6.75% p.a. | 6,000 | Qatar ID holders |

| Doha Bank | 750,000 | Competitive rates | 7,000 | Qatar ID holders |

| Masraf Al Rayan (Islamic) | 1,200,000 | Profit rate ~6.5% | 7,000 | Qatar ID holders |

| Arab Bank Qatar | 500,000 | From 7.00% p.a. | 5,000 | Qatar ID holders |

Note: Masraf Al Rayan offers Sharia-compliant Murabaha financing as an alternative to conventional interest-based loans a popular choice among Muslim residents.

For official rates, always check directly with the bank or visit QCB official website for updated consumer credit regulations.

How to Apply for a Personal Loan in Qatar?

Follow these steps carefully to maximize your chances of a fast approval:

- Check Your Eligibility: Review the bank’s minimum salary requirement and confirm your QID is valid and your visa hasn’t expired. Use online eligibility calculators on bank websites.

- Compare Loan Options: Use the comparison table above to shortlist 2–3 lenders. Compare APR (Annual Percentage Rate), loan tenure, and early settlement fees.

- Gather Your Documents: Prepare all documents from the checklist above. Ensure your salary certificate is not older than 30 days.

- Submit Application: Apply online via the bank’s portal, visit a branch, or use their official mobile app. Online applications are generally processed 30% faster.

- Credit Assessment: The bank will run a credit check through the Qatar Credit Bureau. This typically takes 1–3 business days.

- Loan Offer Review: If approved, review the offer carefully, check the flat rate vs. reducing balance rate, and note any hidden fees such as processing charges (usually 1–2% of the loan amount).

- Sign Agreement & Fund Disbursement: Sign the loan agreement digitally or in-branch. Funds are typically disbursed within 24–48 hours after signing.

Benefits and Drawbacks of Personal Loans for Qatar ID Holders

Benefits

- No Collateral Required: Unsecured loans mean you don’t risk losing assets.

- Flexible Use of Funds: Use for any legal purpose, education, travel, medical bills, or debt consolidation.

- Fast Disbursement: Many banks disburse funds within 24–72 hours of final approval.

- Competitive Rates: Qatar’s regulated banking sector offers transparent and competitive APRs compared to regional alternatives.

- Islamic Finance Options: Sharia-compliant alternatives are available through Islamic banks for Muslim residents who prefer halal financing.

- Online Application: Most major banks now offer fully digital application processes through apps or websites.

Drawbacks

- Salary Transfer Requirement: Many banks require you to transfer your salary to their account, which can be inconvenient.

- Expat-Specific Risk: If you lose your job, your visa and loan repayment ability are both at risk.

- Early Settlement Penalties: Some lenders charge up to 1–2% of the outstanding balance for early repayment.

- Processing Fees: Upfront charges of 1–2% of the loan amount can add up on larger loans.

- Limited Tenure for Expats: Loan tenures for non-Qataris are often shorter than for nationals, affecting monthly installment amounts.

Common Mistakes to Avoid When Applying for Personal Loans in Qatar

- Applying to Multiple Banks Simultaneously: Each hard inquiry can lower your credit score. Shortlist 1–2 lenders first.

- Not Reading the Fine Print: Always check the effective interest rate (not just the flat rate), tenure, and prepayment clauses before signing.

- Ignoring the Debt-to-Income Ratio: Qatari banks generally cap total monthly loan repayments at 50% of your gross salary. Exceeding this means automatic rejection.

- Using Outdated Documents: A salary certificate older than 30 days or an expired QID will result in rejection. Always use fresh documents.

- Not Checking Credit Bureau Status First: Request your credit report from the Qatar Credit Bureau before applying to check for any errors or unresolved issues.

- Overlooking Islamic Finance Options: Muslim applicants sometimes miss out on Murabaha or Ijara financing which may offer better terms aligned with their values.

- Borrowing More Than You Need: Larger loans come with higher total interest costs. Borrow only what you genuinely need.

Conclusion

Personal loans for Qatar ID holders offer a powerful financial tool, whether you need emergency funds, want to finance a major purchase, or consolidate existing debt. Qatar’s regulated banking sector ensures transparent terms and competitive rates.